This is an archived article that was published on sltrib.com in 2016, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

Utah lawmakers are being forced to take a serious look at Utah school funding after the state's most prominent business leaders announced their support for a ballot initiative that would raise income taxes and generate $750 million in new revenue for Utah's poorly funded education system.

Legislators are already making plans to hold hearings on the issue, fearful that they could lose control of how the money is spent if it goes to the ballot and suffers an embarrassing rebuke from voters if they don't act.

"The complaint I'm hearing from these people is, 'We go to the Legislature and they ignore us,' so we don't want to ignore them," said Sen. Lyle Hillyard, R-Logan, co-chairman of the public education budget committee in the upcoming session.

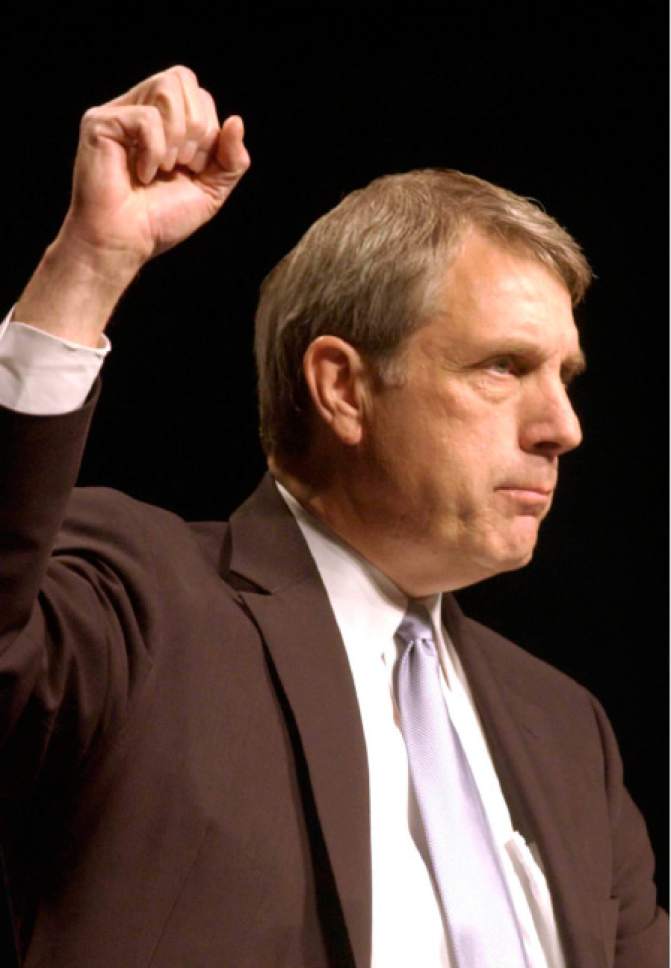

Nolan Karras, chairman of the group Education First, which is working with Our Schools Now on the tax-hike initiative, said that as a former House speaker, he is open to hashing out the issue with legislators, rather than going to voters.

"As an old legislator, I would love to see a legislative solution. It could be much more artful than you would see in an initiative," he said. "It doesn't mean we're any less determined to move forward, but we're certainly willing to work with them."

At the same time, the threat of the initiative appears to be key in forcing legislators to the table.

"There are some gears that have to get turned that simply weren't getting turned," Karras said. "We've gone to the Legislature for the last four or five years. They're people of goodwill, but the political world is tough to go out and say, 'I'm going to raise taxes.'"

Hillyard said he plans to hold a series of hearings starting early in the legislative session to vet the tax-hike proposal from Our Schools Now, the business-backed group that is seeking to increase the state income tax rate from 5 percent to 5 7⁄8 percent — a change estimated to generate $750 million in additional money for Utah schools that are last in the nation in per-pupil spending.

Republican senators discussed how to respond to the tax-hike initiative — among other issues — during a lengthy closed-door caucus meeting on Tuesday, said Senate Majority Leader Ralph Okerlund. That includes discussion of proposals that might take the place of the initiative effort.

"We all see the need, obviously, to try to increase funding a little bit. The question is, how do you do that without gouging the taxpayer, and we just don't know what the reaction would be in the public to the 7⁄8 percent [increase]," Okerlund said.

Senators floated possible alternatives to generate money for education and he said if one of those options gets enough support, they could pass it. Otherwise, the initiative process would likely go forward.

In 2015, Rep. Jack Draxler, R-Logan, sponsored legislation to raise the income tax rate by 0.5 percent, with the proceeds going to education technology and merit pay for teachers, but the bill was crushed by a House committee, that voted 11-2 to kill it.

Karras said that proponents of the tax increase are not simply looking to generate more money for schools, but to make sure that money goes to fulfill crucial needs that currently aren't being met. Pre-kindergarten is one of the top priorities, as is better professional development and retention of teachers.

"The issue for us is not so much that we've got our heart set on a tax increase. We've got our heart set on some changes that need to be made to move the system forward," he said.

Hillyard said he is always concerned when an initiative ends up on the ballot, especially when the effort is well-funded and slick ads can sway voters. Already, opponents are trying hard to make the point that bumping the 5 percent rate to 5 7⁄8 percent actually translates to about a 17 percent increase in the amount taxpayers will pay.

"The initiative process, I hope, never drives the legislative process or what the governor does. I think it's a weapon out there for those who think we're not paying attention," Hillyard said. "Personally, I agree with what [Gov. Gary Herbert] is trying to do and that is let the economic growth pay for education naturally. I personally think a tax increase of 7⁄8 percent would be a death knell and it would undo everything [former Gov.] Jon Huntsman tried to do."

Huntsman pushed through major tax cuts for most Utahns, lowering the top income tax rate to 5 percent. However, because Utah's Constitution earmarks all income taxes to public and higher education, a recent report from the Utah Foundation said that change costs Utah schools nearly $140 million a year — one of a series of tax changes over more than two decades that the foundation said has sapped $1.2 billion annually from the education budget.

If lawmakers respond, it would not be the first time a legislators were forced into action by the threat of a ballot initiative.

In 2014, Count My Vote gathered some 100,000 signatures to put a measure on the ballot changing the way nominees for political office are selected. But at the last minute, the Legislature, fearful that the initiative language went too far and may be fraught with problems, stepped in and passed a compromise measure, SB54.

And years earlier, Hillyard recalled, voters approved an initiative reining in asset forfeiture — when law enforcement is allowed to confiscate property associated with criminal activity. The Legislature tried to change the law the following session and "we got our heads taken off" for attempting to upend the will of the voters.

Twitter: @RobertGehrke